Slightly Shortened Stays Are Contributing to Decreases in Occupancy

7/16/2023

Sponsored by Key Data

June vacation rental performance mirrored the same trends we saw in May: decreasing occupancy rates compared to previous years, the decline of pricing power and RevPAR, and stay lengths and booking windows consistent with last year. With one notable difference: Net reservations were much higher than in 2022, 2021, and 2019. How do these high-level trends break down? Let’s take a closer look.

U.S. Vacation Rental Performance for the Last Six Months

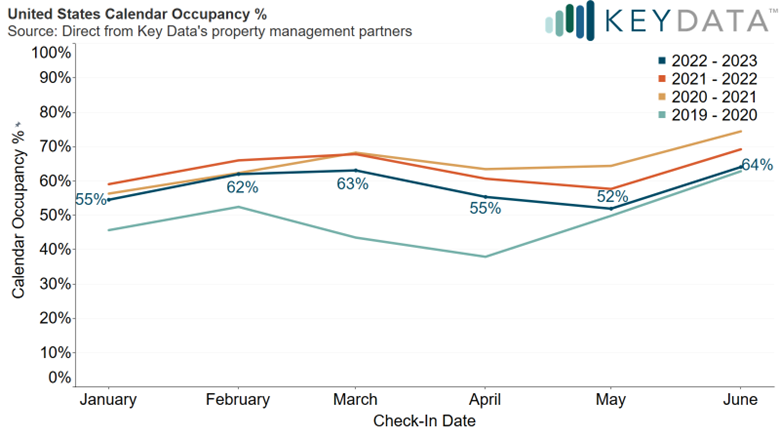

Calendar Occupancy Percentage

Vacation rental demand continues to cool as 2023 occupancy underperforms 2022 and 2021.

Calendar Occupancy % = (Nights Sold + Owner Nights + Hold Nights) / (Total Nights)

In June, calendar occupancy was 5 percent lower than in 2022 and 10 percent lower than in 2021. The number of nights sold is starting to wane after peaks in 2021 and 2022, and combined with increased supply, occupancy is being driven down. Q3 2023 calendar occupancy rates are pacing at 47 percent as of July 11, 5 percent behind Q3 2022 and 12 percent behind 2021. Calendar occupancy is currently pacing at the same rate that it was a month ago, so shortened booking windows may lead to pick-up later in the quarter.

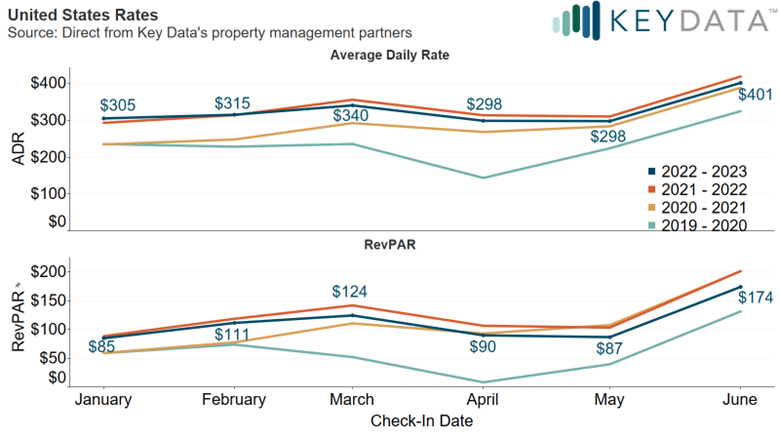

Average Daily Rate

Daily Rates are softening but still higher than in 2021.

ADR = Total Unit Revenue / Nights Sold

The average daily rate in the United States decreased by $17 from June 2022. With increased supply, property managers are facing more competition, and pricing power has declined in the face of lower occupancy rates. With more options and high inflation, consumers may be more price sensitive than they used to be. Additionally, when adjusted for inflation, rates are much lower than last year. Q3 2023’s nightly rates are pacing $1 higher than in Q3 2022 ($436), and $36 higher than in Q3 2021 ($401).

RevPAR

June RevPAR was lower than last year and in 2021.

RevPAR = Occupancy x ADR or Total Unit Revenue / Total Nights in a given period

RevPAR suffered because occupancy and rates decreased, which led to decreased RevPAR. At $174 per active property per night, revenue decreased by $27 from June 2022. This trend began in Q4 of 2022 when RevPAR was $7 lower than in 2021 and continued through Q1 2023 with RevPAR figures averaging $10 lower than in 2022. Q3 2023 RevPAR is currently pacing $21 behind Q3 last year ($144) and $29 behind Q3 2021 ($152). Now is the time to communicate openly with your owners and shift strategies for the coming months. Consider implementing light discounts or price decreases and focus on capturing bookings outside your markets’ typical booking windows. We anticipate less investment activity in many markets due to high mortgage rates and lower revenue potential.

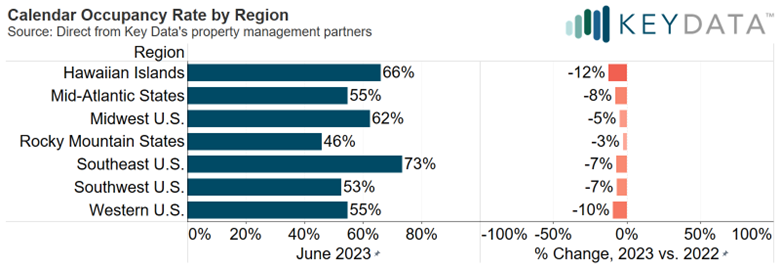

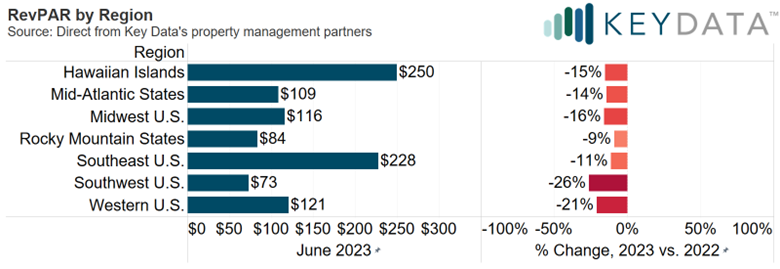

U.S. Regional Vacation Rental Performance

All regions saw a decrease in year-over-year calendar occupancy for May 2023. The Hawaiian Islands saw the steepest decline in occupancy (-12 percent). This is the second consecutive month of dramatic decreases the Hawaiian Islands have experienced after consistently increasing year-over-year occupancy for the majority of the past nine months. However, most regions’ decreases were only slightly better; between -7 percent to -10 percent. Calendar occupancy is still higher than it was in June 2019 for all regions. The Midwest U.S. saw the largest increase; June 2019 calendar occupancy was 43 percent, and in June 2023 it was 62 percent (a year-over-year increase of 19 percent). The remaining regions’ calendar occupancy increased between 4 percent (Southeast U.S.) and 12 percent (Southwest U.S.).

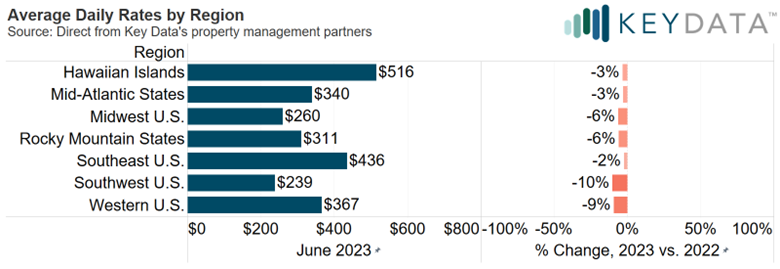

All regions above saw lower nightly rates year-over-year in June 2023, but the Southeast U.S. fared better than the other remaining regions (-2 percent). Demand has waned, so guests are likely no longer willing to book reservations at the rates they were this time last year. Though rates in the Hawaiian Islands are only 3 percent lower last month than in June 2022, they are 54 percent higher ($518) than in 2019 ($337). The remaining regions saw relatively similar increases in nightly rates compared to 2019 ($39-$46), except the Midwest U.S. Rates in this region decreased from 2019 to 2023 (-$19).

With marked decreases in both occupancy and nightly rates, RevPAR has also declined year-over-year for all of these regions. The Rocky Mountain States (-9%) and Southeast U.S. (-11%) saw the smallest decreases, but they are still significant. The Western U.S. saw a decrease of 21%, while the Southwest U.S. saw the largest decrease at -26%. Compared to 2019, the Hawaiian Islands saw the largest increase in RevPAR; a 75% increase ($143 to $251). The Southeast U.S. saw a $43 increase in RevPAR; during one of its peak summer months. The remaining regions saw a $20-$33 increase.

U.S. Vacation Rental Performance; Booking Activity

Net Reservations Per Active Property

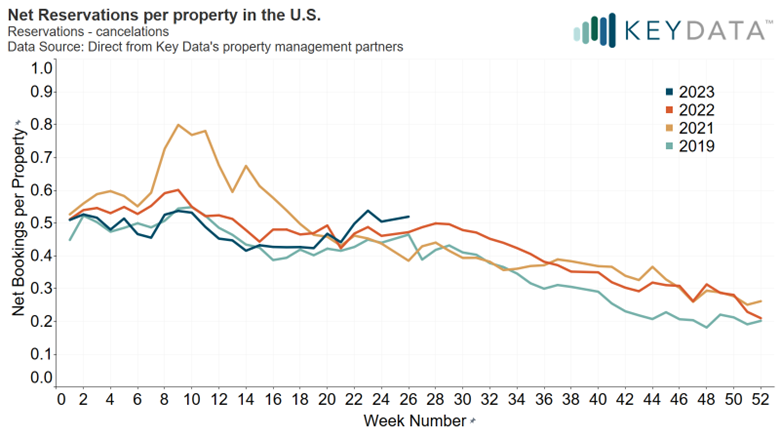

Net reservations overtook 2022, 2021 levels in May, and are continuing to increase.

Net Reservations Per Property = (Bookings Made - Cancellations) / Active Properties

In the first 14 weeks of 2023, net reservations resembled the seasonal patterns of 2022, suggesting we can expect booking activity that follows a normal pre-pandemic annual trend. However, in volume, it resembles 2019 trends. There was a slight dip in net reservations in Q1, but inflated supply is likely influencing this decrease. At the beginning of Q2, net reservations started to climb past 2019 levels and have continued through the week of April 30 (week 18). Starting the week of May 14 (week 20), net reservations have outperformed both 2022 and 2021. From week 22 (May 28) to week 26 (June 25), the increase in net reservations is continuing to grow. In the last week of June 2023, net reservations increased 12 percent compared to 2019, 35 percent compared to 2021, and 10 percent compared to last year.

Average Length of Stay and Booking Window

Average Length of Stay

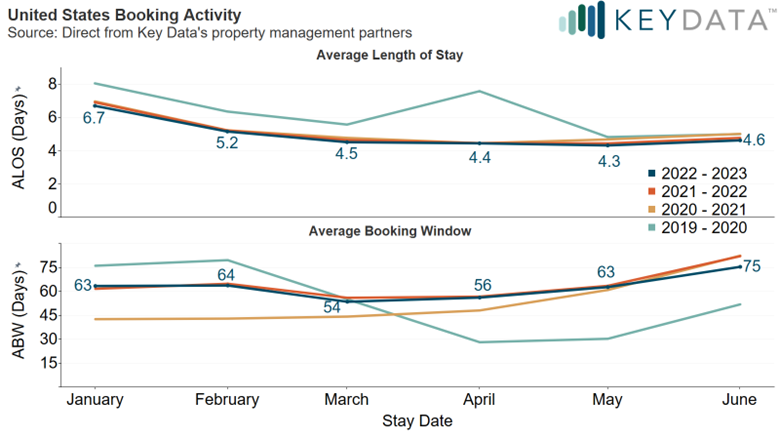

The average length of stay has stayed very consistent throughout the past four years.

Average Length of Stay = Total Nights Sold / # of Guest Check-ins

Typically, the length of stay during winter is slightly longer due to snowbird stays, as evidenced by a two-day spike in January. This trend has not deviated much through the years, except in Q1 2020, where ALOS was roughly one day longer than in the last three years. At 4.6 days in June 2023, are 3 percent shorter than last year, 8 percent shorter than in 2021, and 7 percent shorter than in 2019. Though that change seems minute (-0.15, -0.39, and -0.37 days, respectively), the 3 percent decrease in the average length of stay from last year leads to 3 percent fewer nights sold if the number of reservations remains the same.

Average Booking Window

Booking windows are on par with 2022 and 2021, but still significantly longer than in 2019.

Average Booking Window = (Arrival Date - Booked Date) / # of Guest Check-ins

In the past five months, booking windows have been extremely similar to the previous year’s, until June’s average booking window finished at 75 days, compared to 82 days last year, and 52 days in 2019. Of the stays with arrival dates in June 2023, 23 percent were booked within 14 days of the stay, 15 percent were booked 15-29 days prior to check-in, 18 percent were booked 30-59 days prior to check-in, and 44 percent were booked 60+ days in advance. A majority of these June summertime stays were booked more than 60 days out but, compared to last year, the 15-29 day booking window increased 2 percent, and the 60+ day booking window decreased 4 percent. With shortened booking windows, ensure you have an appropriate pricing strategy to capture last-minute bookings.

State of the U.S. Economy

The inflation rate in the United States slowed yet again during June, from 4 percent in May to 3 percent. This marked a full year of year-over-year inflation rate decreases and is at the lowest level since March 2021. In short, Americans are paying an average of 3 percent more for goods and services than in May of last year. On a monthly basis, the index rose 0.2 percent, slightly better than the expected increase of 0.3 percent.

Gasoline costs increased by 1 percent from May to June 2023, following a 5.6 percent decrease from April to May 2023. Airfare decreased by 8.1 percent over the month, after falling 3 percent from April to May 2023.