Vacation Rental Tax Compliance in 2025: What Property Managers Need to Know

Caitlin Foster

3/24/2025

Sponsored by Avalara

The short-term rental industry is poised for significant growth in 2025, presenting exciting opportunities for vacation rental property managers. However, alongside this expansion comes increasing regulation, new tax obligations, and shifting market trends that could impact your business.

Understanding these changes is essential for staying compliant, optimizing revenue, and ensuring a seamless experience for your guests. Avalara has recently released its 2025 Tax Changes Guide for the Lodging Industry, providing insights into the latest regulatory shifts and tax requirements affecting vacation rentals. Below, we’ll cover key takeaways from the report and what you need to know for 2025.

Short-Term Rental Demand Remains Strong

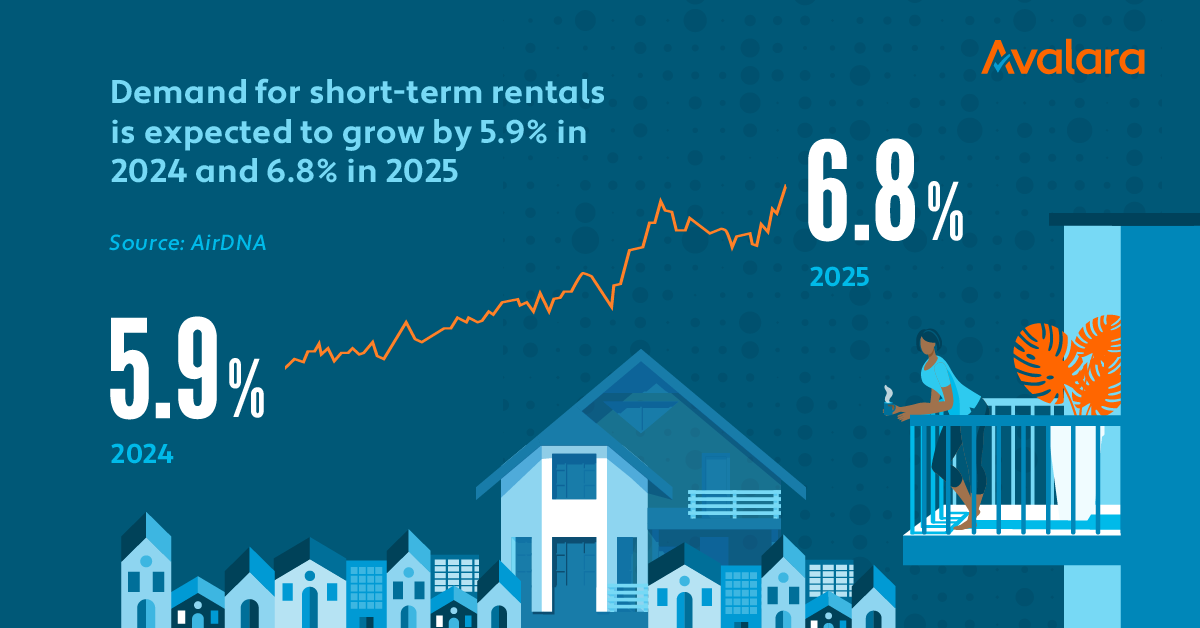

Travel enthusiasm is at an all-time high. According to industry research, 66% of travelers are more interested in travel now than before the pandemic, and short-term rentals are set to grow by 5.9% in 2024 and 6.8% in 2025.

By 2037, the STR market is expected to reach $478 billion, up from $125 billion in 2024. For property managers, this means increased demand—but also heightened competition and regulatory scrutiny.

Regulatory Challenges and Compliance Risks for Property Managers

While the vacation rental industry thrives, local and state governments are tightening regulations. Many jurisdictions are focusing on tax enforcement and rental restrictions, requiring property managers to stay ahead of compliance challenges.

Key Regulation Updates in 2025:

- Strict STR Laws in Major Cities

- New York City and New Orleans: New laws limit STRs to one per host, require hosts to be present during stays, and ban internal locks on doors, effectively restricting many vacation rentals.

- Other cities and counties are introducing similar measures, often targeting non-owner-occupied STRs.

- Hidden Fee Bans Impacting Pricing Strategy

- California’s “Honest Pricing Law” (effective July 1, 2024) prohibits lodging platforms and property managers from advertising rates that exclude mandatory fees (e.g., cleaning fees, pet fees).

- Similar legislation is under consideration in Connecticut, New York, and Minnesota.

- New STR Tax Laws at State and Local Levels

- Several states, including Delaware, Vermont, and Michigan, have implemented STR-specific tax surcharges ranging from 3% to 8%, further complicating compliance.

- Local jurisdictions are increasingly using data mining services to uncover noncompliant STRs.

These regulations mean more paperwork, tighter restrictions, and potentially higher costs for property managers. Staying compliant will require proactive tax management and automation tools.

Tax Compliance for STR Marketplaces and Property Managers

If you manage vacation rentals across multiple platforms (e.g., Airbnb, Vrbo, Booking.com), understanding marketplace facilitator laws is critical.

Key Tax Compliance Changes in 2025:

- Inconsistent Definitions Across States

- Some states classify STR platforms as marketplace facilitators, requiring them to collect and remit taxes on behalf of property owners. Others do not, meaning property managers may still be responsible for tax compliance.

- Platform-Specific Collection Policies

- Tennessee allows STR marketplaces to seek tax waivers, but not for all short-term rental laws.

- Virginia enforces marketplace facilitator laws that mandate platforms to collect and remit all applicable lodging taxes.

For property managers who list on multiple platforms—or take direct bookings—understanding tax obligations for each state and marketplace is essential to avoid penalties.

Extended Stay Hotels Are Becoming a Strong Competitor

As regulations on vacation rentals tighten, extended-stay hotels are becoming an attractive alternative for travelers.

Why Extended Stays Are Gaining Popularity:

- Lower tax burdens – Many extended stay properties qualify for exemptions from lodging taxes.

- Simplified compliance – Unlike STRs, extended stays operate under more consistent regulations across jurisdictions.

- Steady demand – The extended stay hotel market is projected to grow at an 11.8% annual rate, reaching $166.58 billion by 2033.

For property managers, this shift means competing on guest experience, pricing, and long-term stay incentives to retain bookings.

Final Thoughts: Simplify Compliance and Focus on Growth

The vacation rental market in 2025 presents both tremendous opportunities and increased compliance challenges. For property managers, staying ahead means understanding tax laws, automating compliance, and adapting to new market trends.

To help you navigate these changes, Avalara’s 2025 Tax Changes Guide for the Lodging Industry offers expert insights into regulatory updates, tax compliance strategies, and industry trends. Download a free copy for more trends and a deeper analysis of those discussed above.

Caitlin Foster

Caitlin Foster is a senior marketing manager for lodging at Avalara.