8 Myths About Short-Term Rentals

10/17/2019

Sponsored by Transparent

Myth 1: The Short-term Rental Industry is Not that Big

Globally, the short-term rental supply listed on major online travel agencies grew 33% from 2017 to 2018 to reach a total of 7.1 million properties.

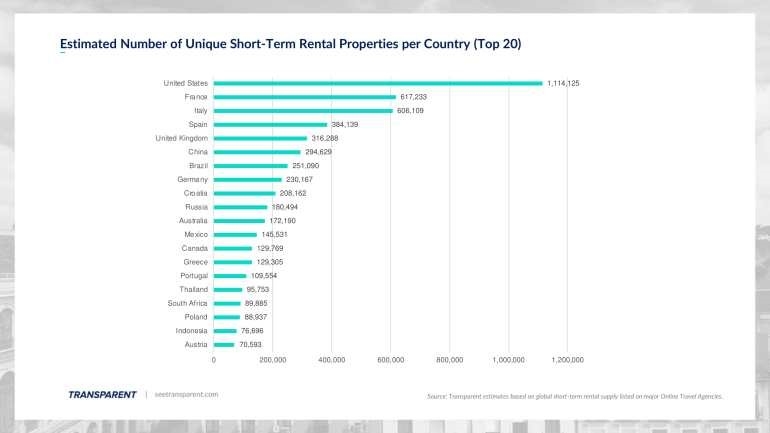

This chart shows the relevance of the short-term rental inventory in the largest 20 short-term rental countries worldwide.

Myth 2: The Short-term Rental Industry is not Relevant Compared to the Hotel Industry

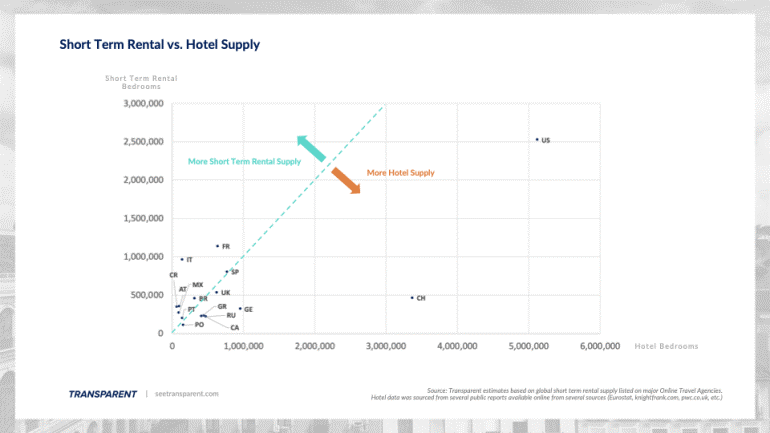

In this chart we compared the number of hotel rooms with the number of short-term rental bedrooms. Countries like France, Italy and Croatia have more short-term rental supply than hotel supply. In the United States, almost on in every three bedrooms available for travellers is in a short-term rental.

Myth 3: Short-term Rentals Are Mostly Beach Houses and Countryside Properties

Traditional houses and villas still account for a large part of the total global short-term rental supply, but contrary to most expectations, short-term rentals are predominantly apartments.

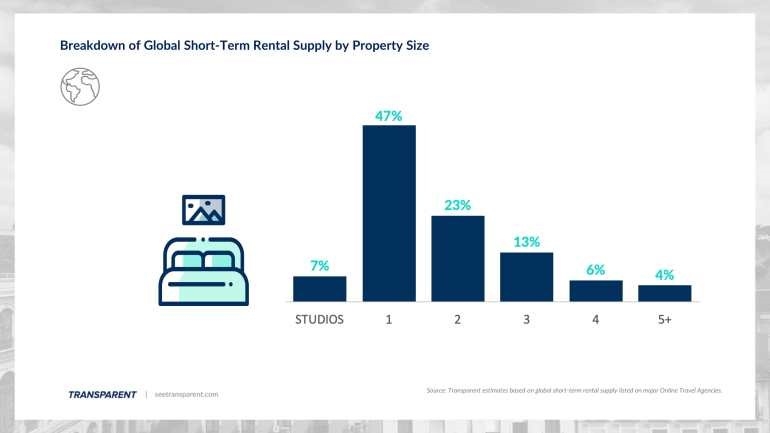

Myth 4: Short-term Rentals are for Families and Large Groups

Most short-term rentals are actually one-bedroom properties, an inventory similar to a very competitive hotel, offering a sofa bed in addition to the main bed, a kitchen and other competitive amenities.

Myth 5: Short-term Rentals Are for Leisure Destinations

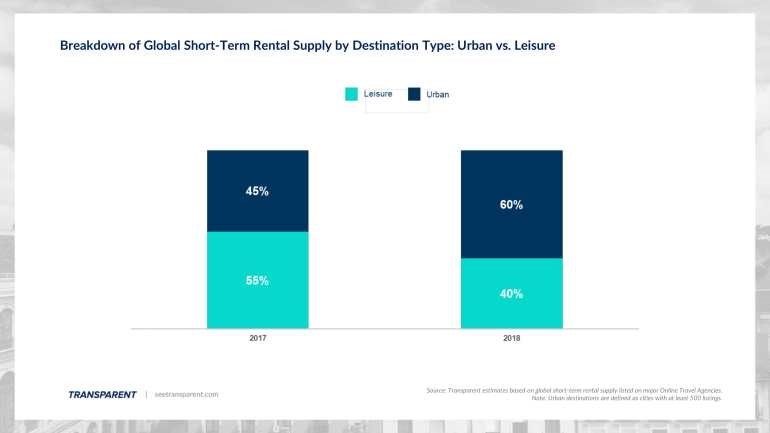

Urban markets have developed rapidly, resulting in the emergence of competitive short-term rental destinations such as Paris, London, Amsterdam, Los Angeles, Miami, New York, San Diego and more.

Traditionally, short-term rentals were mostly located in leisure destinations (destinations where the primary goal for most travellers was a vacation), but in 2018 the global short-term rental inventory became predominantly urban for the first time.

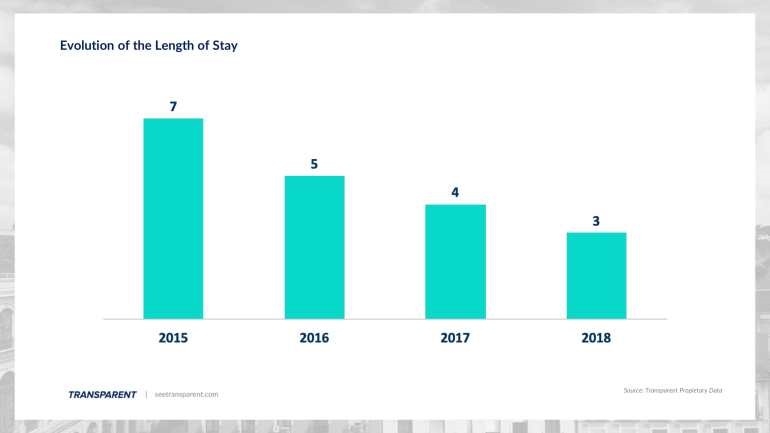

Myth 6: Short-term Rentals Are Used for 7-Night Stay Vacations

Global trends in length of stay show a decrease in the average length of stay, from seven nights in 2015 to three nights in 2018.

This phenomenon is due to two main factors:

- As the inventory is becoming more urban, travellers’ booking patterns are getting increasingly similar to urban destinations booking patterns

- Short-term rentals are being considered as a viable alternative to hotels, according to travellers. Because of this, booking patterns are becoming more similar to hotel bookings.

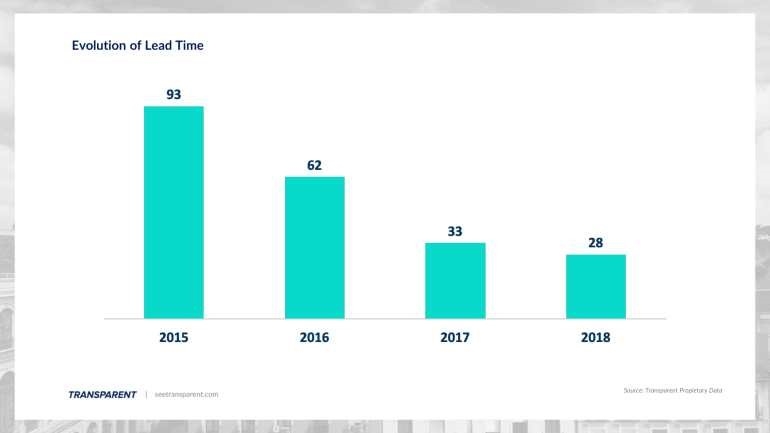

Myth 7: Travellers Using Short-term Rentals Plan Further in Advance

In 2015, a typical short-term rental was booked three months in advance, on average. In 2018, the average booking window has declined by two-thirds, to an average of 28 days. A booking pattern, once again, very similar to a hotel booking pattern.

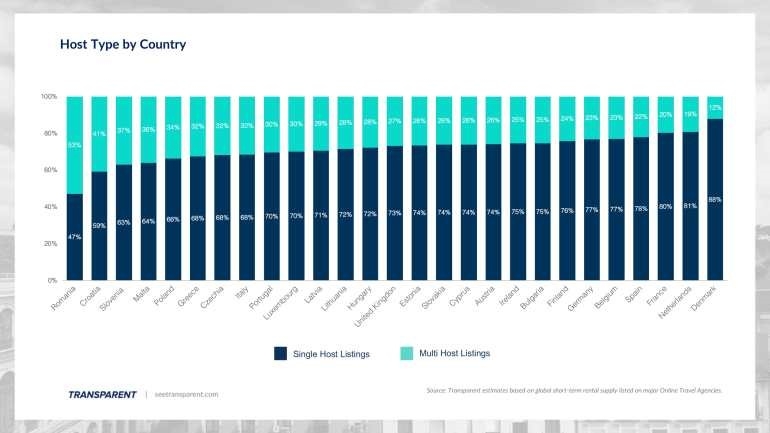

Myth 8: Short-term Rentals Equal a Sharing Economy

This chart shows the percentage of hosts that manage a single listing vs. the percentage of hosts managing multiple units. In most destinations, the largest part of the total supply is managed by professionals managing multiple properties and delivering a professional experience to their guests.

Conclusion

Short-term rentals represent a massive proportion of the hospitality industry worldwide. Due to the high fragmentation of the market, it is often hard to understand its size. This is why Transparent develops insight on market conditions, such as supply growth, demand patterns, pricing changes and property managers’ activities.