Is ‘Benchmarking’ the STR World’s Most Overused Buzzword?

Dillon DuBois

12/1/2022

Sponsored by AirDNA

The concept of “benchmarking” has become a pretty exhausted platitude in the short-term rental industry. It is possibly the most talked about, least acted-upon concept in the game.

While it’s often the subject of keynote speeches and conference roundtables, very few vacation rental managers actually do it (and do it well). We like to say we’re avid benchmarkers, but how many of us actually are?

If you don’t know what benchmarking is, don’t know how to start, dread doing it, or simply want to improve your chops, this article is for you. Here’s all you need to know about benchmarking and why it’s table stakes for 2023.

Step 1: Check Yourself Before You Wreck Your (Business)

Before starting, it’s helpful to check how much benchmarking is currently involved in your day-to-day operations. Here’s a quick litmus test:

“I use benchmarking data to”:

- Create comp sets for my properties.

- Compare markets side by side.

- Create projections for owners and acquire more listings.

- Determine whether my listings are leaving money on the table.

- Show owners how they’re performing compared to the wider market.

You’d think benchmarking is limited to the operations phase when, in reality, it's essential to every step of your property management journey. If you’re not doing all of the above, here’s a good starting point.

Step 2: Determine Where to Target

Benchmarking starts well before you actually own or operate a property. It starts in the research and acquisition phase when finding the best markets for your business.

In order to determine where to target, the savviest vacation rental pros use benchmarking data to find answers to questions like these:

- Which markets and specific neighborhoods are seeing increased demand? What’s true today wasn’t necessarily true last year. For example, drive-to national parks and coastal destinations that boomed in popularity during the pandemic—places like Joshua Tree, Lake Tahoe, and Big Bear—are now experiencing different patterns. Use benchmarking data to pull comps in one market and see whether demand is increasing or decreasing compared to other markets.

- Which markets have seen supply growing faster than demand? Are you targeting a market with skyrocketing supply? Probably best to think twice. Properties in markets with the greatest supply growth are seeing the biggest declines in performance. In August, we reported that markets where supply was growing greater than 30 percent year over year were seeing significantly weaker performance than those in markets where supply was growing less than 30 percent.

- How much do superhosts and professionally managed properties make? Averages are the biggest pitfall of any property management operation. Instead of comparing yourself to market-wide averages, drill down into how superhosts and professionally managed listings are performing in your target market.

- How heavily regulated is my target market? Imagine expanding into a new market only to later realize how limiting the regulations are. The data that powers regulation scores and advocacy scorecards is crucial in determining the best places to expand.

Once you realize how easy it is to pull data for your expansion research, finding markets that actually make sense for your business and brand becomes a breeze.

Step 3: Discover What to Target

In addition to determining the best markets for launching your future operations, it’s equally important to figure out which types of properties perform best.

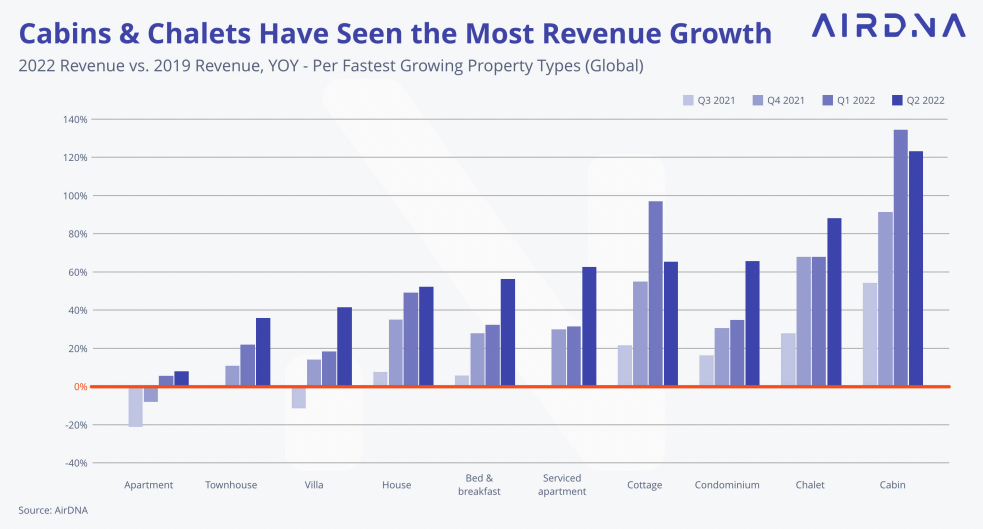

In some markets, the return on investment for studios and one-bedrooms vastly outperforms that of larger units. In other places, having a unique property like a cabin or a yurt is wildly better than a standard single-family home.

Accurate benchmarking data allows growth-oriented property managers the ability to target the exact type of property that makes sense in a given area.

Step 4: Honing Your Listing’s Brand

Once you onboard a property, leverage benchmarking data to drive decisions on aesthetics.

Do the best-performing properties nearby have a rustic desert feel, or are they shiny and modern? Is there more demand for luxury, mid-range, or budget properties?

The data behind your answers to these questions will help inform critical decisions on whether or not renovations are required and how much you should invest.

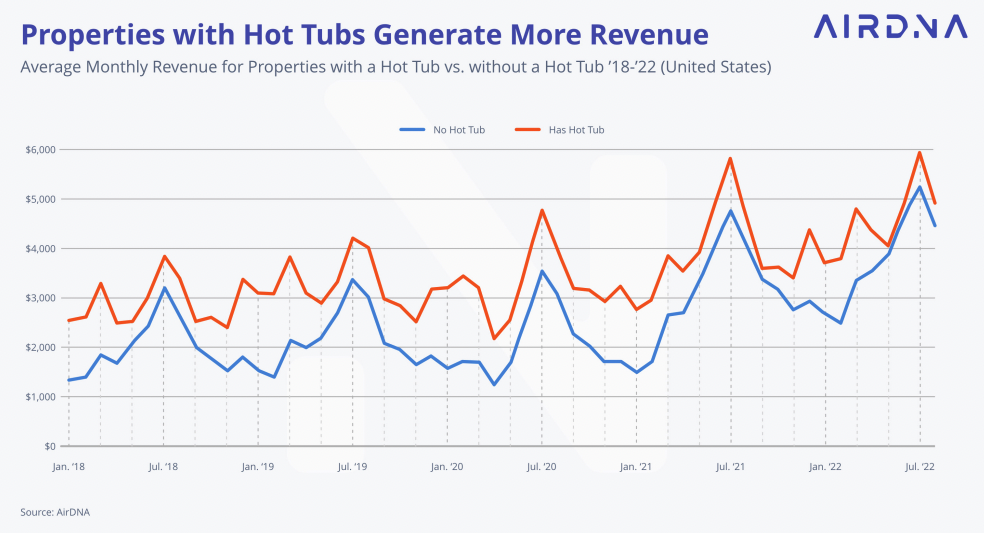

Finding the right amenities is another critical takeaway from benchmarking data. The amenities you should include vary greatly by location: a pool is table stakes in desert locations, while a fireplace can increase your occupancy in mountain properties. A hot tub and being pet-friendly can significantly increase average rates in all destinations.

The bottom line is: Check what’s missing in your market. If everyone has work essentials, you should get them, too. But if no one has a cinema room, then maybe it can give you the competitive edge you need to supercharge your bookings.

Step 5: Setting Your Rates

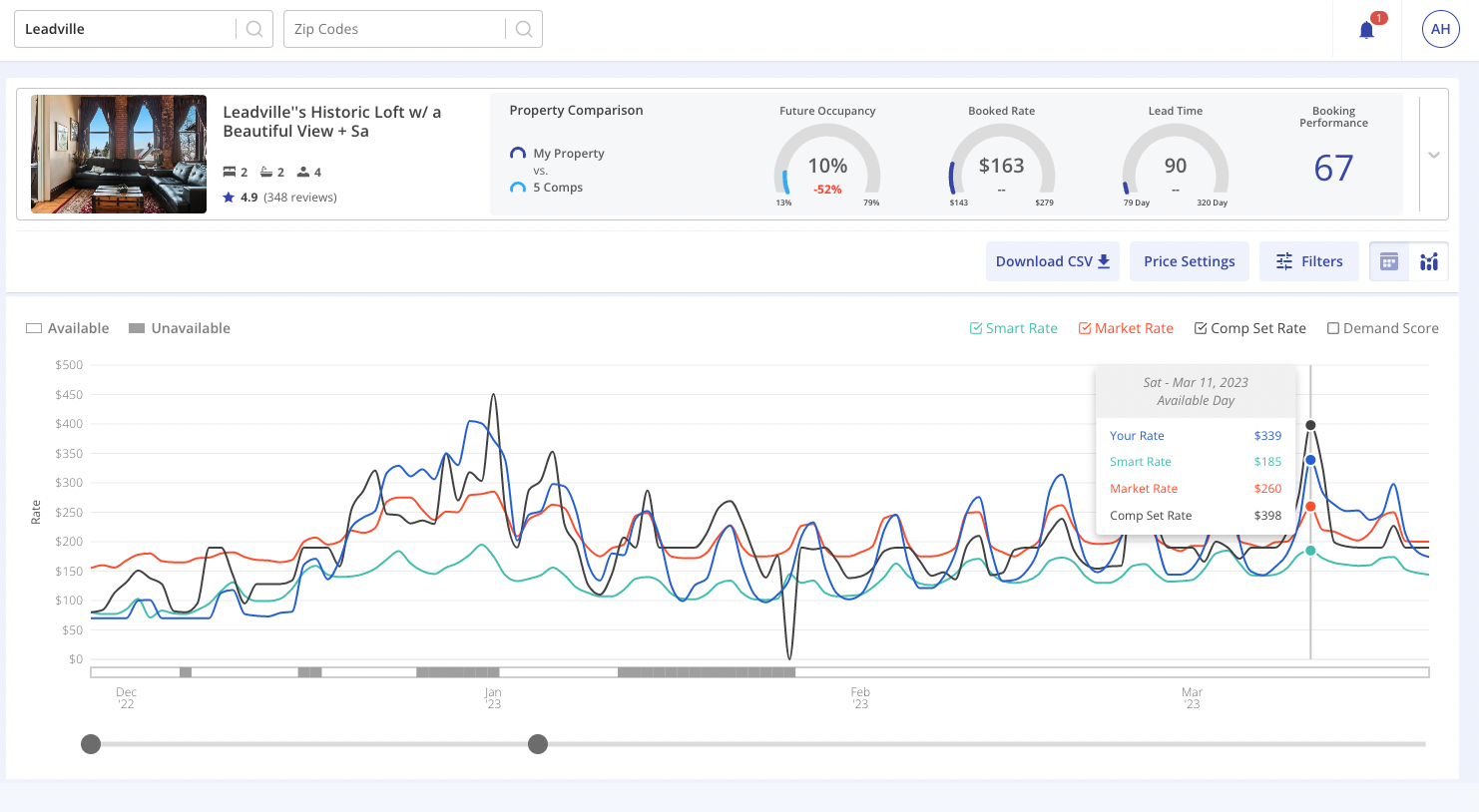

This much is for sure: Dynamic pricing tools have come a long way in the last few years. It’s hands-off, set-it-and-forget-it easy.

But most VRMs still feel the algorithms are a bit too much of a black box. The sauce is a little too secret. Ask yourself, “Am I 100 percent confident my pet-friendly, three-bedroom cabins are not leaving money on the table?”

Top VRMs use benchmarking data to corroborate suggestions from revenue management tools. Having a clear grasp on exactly how the market is priced for exact days is empowering.

Takeaways: How Benchmarking Can Make You a Stronger VRM

- Benchmarking data helps the best property managers expand into the right markets at the right time by uncovering spots with increased demand and limited supply growth.

- Benchmarking helps managers acquire the right listings. Long gone are the days of growth for growth’s sake; it’s now about onboarding the best listings that truly make sense for your revenue goals.

- It allows you to perfect your brand. With the right data, managers can steer their brand in the right direction with the right look and feel.

- Using benchmarking data to vet decisions from your revenue management tools gives you complete oversight on the market and how your listings stack up.

Conclusion: Need a Benchmarking Tool? Try AirDNA’s Property Performance Dashboard

Here at AirDNA, we’re big on benchmarking. We’ve helped over 2,000 vacation rental managers make the transition from non-benchmarker to benchmarker, and subsequently watch their businesses go up and to the right.

Our go-to solution is the Property Performance Dashboard, a Swiss army knife whose groundbreaking insights will take your vacation rental business to the next level. Use benchmarking data from the dashboard to discover the most profitable markets, acquire more listings, improve portfolio performance, and keep homeowners happy. Visit airdna.co/property-performance-dashboard to try the dashboard yourself and find out the difference data makes.

Wondering how inflation, interest rates, and booking patterns will impact the short-term rental industry in the upcoming year? Do not miss the 2023 Outlook webinar with AirDNA Vice President of Research Jamie Lane and Sales Director Julio Hansoul as they unpack the most important insights on our industry’s most dominant trends in 2023, available to VRMA members for free in the webinar archives.

Dillon DuBois

As the director of enterprise marketing at AirDNA, Dillon DuBois leads the development and implementation of marketing programs promoting AirDNA’s vacation rental solutions for businesses. His initiatives have helped thousands of property managers, investors, lenders, and tourism organizations use data to capitalize on short-term rentals. He’s spent five-plus years working in the industry, developing a deep understanding of customer needs, pains, and the way data is used to grow businesses. DuBois is also a short-term rental investor and manages a property in Medellín, Colombia.