Short-Term Rental Market Update and Forecast: US Summer Destinations

9/1/2022

Sponsored by Beyond

Increased Costs and High Travel Demand

Travel demand was expected to soar this summer in short-term rental markets located in sunny destinations around the country. However, at the same time travel costs rose significantly, inflation reached new highs, and a possible recession is looming—a situation not so sunny.

At Beyond, we have extensive market data that allows us to get a clear picture of how 2022 performed when compared to previous years. Let’s take a look at performance in summer destination markets across the U.S. From there, we’ll dive into our recommendations for property managers.

Interested in drilling down into your specific market? Try Insights today to see how you can access actionable, comprehensive short-term rental market data.

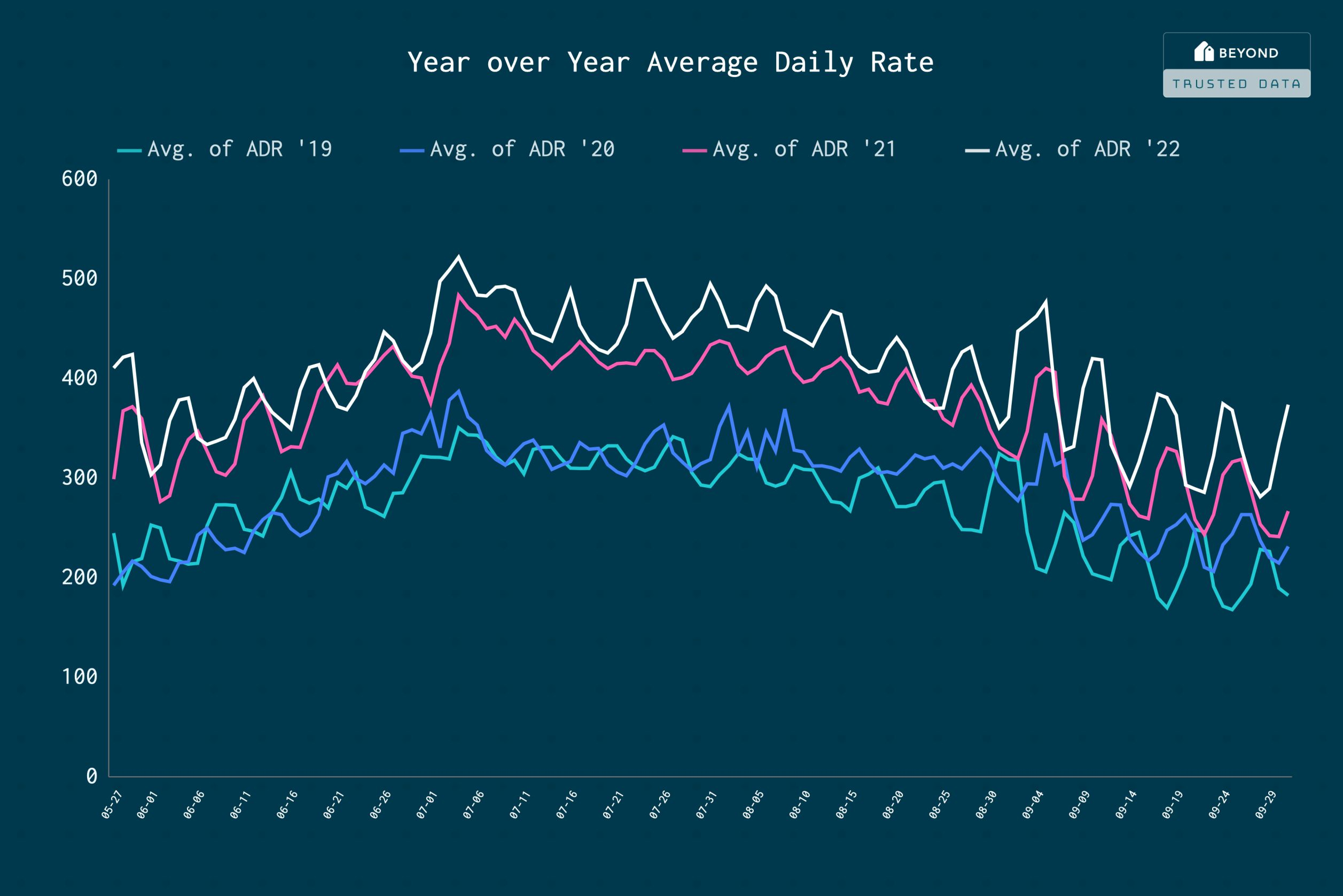

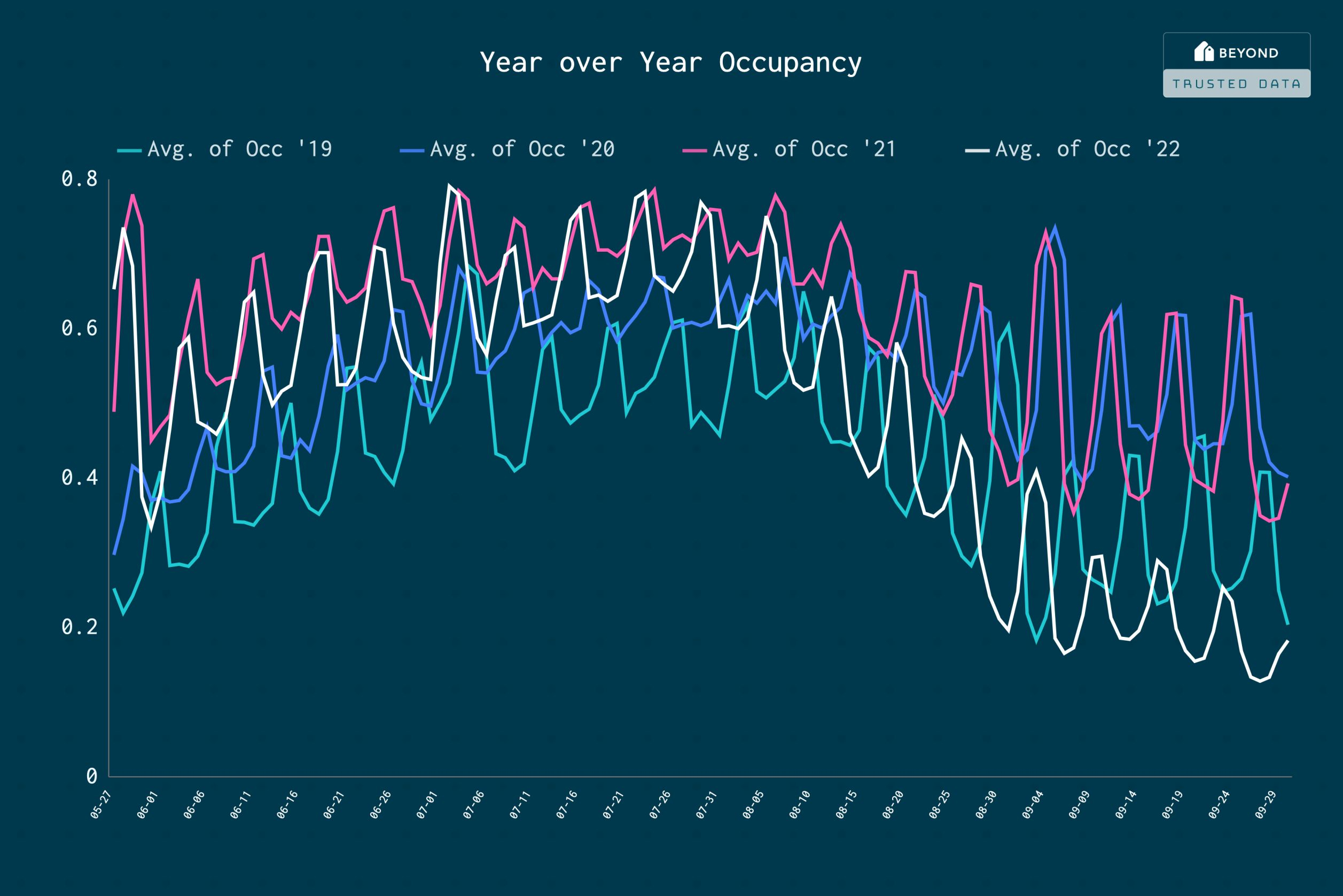

Summer 2022: High Average Daily Rates Paired with Lower Occupancy Levels

2022 average daily rates (ADRs) were much higher than 2021, but occupancy levels were mostly lower in summer destination markets. We can take away a few conclusions from this data.

First, we can see that each booking is bringing in more revenue for property managers due to the higher ADRs. However, when taking occupancy levels into account, the vacation rentals with higher rates are not being booked as often. Demand for short-term rentals did exist at high levels this summer, but travelers were not willing to pay what they did last year, and there were more options to choose from as supply continues to increase.

Second, we can undoubtedly see that the short-term rental industry is growing. While occupancy levels were slightly below last year, they are still much higher than the last pre-pandemic year of 2019—a great sign for the overall growth of our industry.

Early Shoulder Season Forecast

As for the upcoming shoulder season, we see a different picture. First, we can see the expected drop in occupancy from peak summer; however, that drop approaches 2019 levels. And ADRs are still exceptionally high across the board. In some markets, these high rates are making it difficult for property managers to score bookings, and most property managers are in danger of overpricing.

How Property Managers Can Respond

Based on how the market looks, we recommend that hosts and property managers evaluate their pricing strategy first. It might be time to pivot to a strategy that drives for occupancy so that you can capture existing demand:

- When demand is lower, make sure that you are getting your fair share of bookings. Think about adjusting minimum prices, minimum stay requirements, lead times, and length of stay discounts so that every adjustment is still within your standards.

- We recommend utilizing a revenue management platform to access critical data about your market to inform your pricing strategy.

- Be sure you are proactively communicating with your owners. While these conversations might be difficult to have with your owners, the overwhelming feedback we hear from our property managers is that it is better to be candid and proactive.

Get Actionable, Comprehensive Short-Term Rental Market Data with Beyond

With our dynamic, demand-driven pricing tool and extensive market data, Beyond aims to be your best partner in revenue management strategy. See what Beyond can do for your business by contacting us.